Top 10 Questions a W2 Employee Needs to Ask Before Buying a Small Business

Top 10 Questions a W2 Employee Needs to Ask Before Buying a Small Business

Leaving a secure W2 job to buy a small business is a big decision. It’s important to ask yourself key questions to ensure you're making a wise investment. Here are the top 10 questions you should ask:

#1. Why Do I Want to Buy a Business?

- Are you looking for more freedom, financial gain, or personal fulfillment? Understanding your motivation helps ensure you’re making the decision for the right reasons.

#2. Do I Have the Necessary Skills and Experience?

- Running a business requires a diverse skill set. Assess your strengths and weaknesses to determine if you’re ready for the challenge. Whatever you do, don’t call a business broker and tell them you are open to buying anything. That’s a waste of their time and sets you up for failure. Look at business where you have industry experience.

#3. Can I Handle Financial Risk?

- Owning a business means taking on financial risk. You need to be comfortable with the potential for income variability and the possibility of financial loss.

#4. How Will This Impact My Lifestyle?

- Owning a business often requires long hours and can be stressful. Consider how this will affect your personal life and family. Look at the sellers lifestyle. There is a good chance his lifestyle may become your lifestyle.

#5. What Type of Business is Right for Me?

- Choose a business that aligns with your skills, interests, and financial goals. Research different industries and market demands.

#6. What is the Financial Health of the Business?

- Analyze the business’s financial statements, including income, expenses, and profitability. Look at historical performance and future projections. You should buy for future growth but pay for historical performance.

#7. What is the Business’s SDE and EBITDA?

- Sellers Discretionary Earnings (SDE) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) are key indicators of a business’s profitability. These metrics help determine the business’s value. You need to calculate and value a business, using both of these figures is key. Don’t let any business brokers trick you into thinking SDE really means profit.

#8. How Much Should I Pay for the Business?

- Understand how to value the business using multiples of SDE and EBITDA. Ensure the price is fair and justifiable.

#9. How Will I Finance the Purchase?

- Explore financing options, such as SBA loans, seller financing, or personal savings. Understand the terms and requirements of each option. Don’t fall for the latest trend of buying a good business for no money down. Being over leveraged is setting yourself up for a high degree of failure. Besides, the really good business rarely are sold for $0 money down.

#10. Will the business produce more income and give me a better quality of life than my w2 job can?

- You should be able to answer yes to both questions here, making more money and have a better quality of life. This may be the most important question and unless you really dig into the math, you can’t make an informed decision. Let me illustrate how easily this could go wrong.

Example: Financial Analysis for a W2 Employee Making $100,000

#Current W2 Income and Benefits

- Annual Salary: $100,000

- Benefits (estimated 20% of salary): $20,000

- Total Compensation: $120,000

#Desired Business

#Business Valuation Using Multiples

1. SDE Multiple:

- Assume the business has SDE of $250,000.

- Using a 2.5 multiple:

2.5 times $250,000 = $625,000

- EBITDA: $165,000 (after adjusting for owner's replacement)

- Owner’s Replacement Wage: $85,000

- Adjusted EBITDA: $250k - $85,000 = $165,000

2. EBITDA Multiple:

- Adjusted EBITDA: $165,000

- Using a 3.8 multiple:

3.8 times $165,000 = $627,000

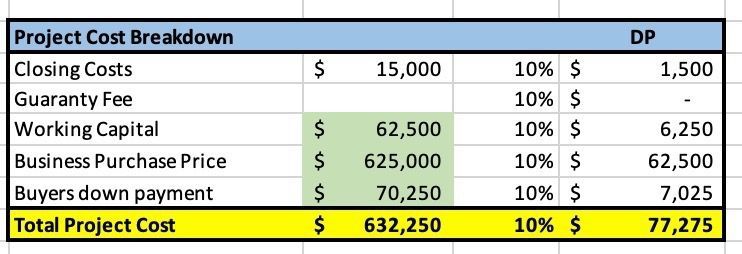

#Financing with SBA Loan

- Down Payment: $65,000 (10%)

- Loan Amount: $625,000

- Interest Rate: 11.5%

-10% working capital factored in by the lender + lender costs

- Loan Term: 10 years

Using a loan calculator, the monthly payment for an SBA loan the annual debt service (loan payment) would be:

#Cash Flow Analysis

- SDE of $250,000

- Buyers livable wage: $85,000

- Adjusted EBITDA: $165,000

- Annual Debt Service: $93,632

- Remaining Cash Flow:

165,000 – 93,626 = $71,374

#Comparison to Current W2 Job

- Current Total Compensation: $120,000

- Potential Business Cash Flow: $85,000 wages + $71,374 profit left over after debt service = $156,371

In this example, buying the business would result in a slight increase in overall net profit to the owner operator vs. remaining at his dreaded but secure $120,000 w2 job.

So is it worth it? You’ll have to decide.

What would I do? I am glad you asked! I’d leave my day job in a heartbeat but instead of buying this size of a business, buy something twice the size, which produces much more profit to the family.

Buying a small business can be a lucrative and fulfilling venture, but it requires careful consideration and thorough analysis. Make sure to carefully run the financial analysis so you can determine IF buying a business is right for you but more importantly, WHAT SIZE OF BUSINESS to make sure it’s worth leaving the w2 job. Always consult with financial advisors and business brokers to ensure you’re making the best choice for your future.