Understanding Debt Service Coverage Ratio (DSCR) in Business Purchases

Understanding Debt Service Coverage Ratio (DSCR) in Business Purchases

Here is an important topic if you are interested in buying a business. Understanding the Debt Service Coverage Ratio (DSCR). A buyer recently asked me about a situation where a bank deemed a business overpriced due to its DSCR.

Let’s break this down to understand what DSCR is and why it’s crucial when buying a business.

What is Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) measures how much cash is available to pay off debt. It compares a business’s net operating income to its debt obligations. In simple terms, it tells us how well a business can cover its debt with its current cash flow.

How to Calculate DSCR

To calculate DSCR, you need to know:

Net Operating Income (NOI): The profit after all operating expenses are deducted.

Debt Service: The total amount of principal and interest payments on debt.

The formula is:

DSCR = Net Operating Income/Debt Service

For example, if a business has an NOI of $1,000 and debt service of $500, the DSCR would be:

DSCR= 1,000/500=2

This means the business has $2 of income for every $1 of debt obligation.

Why is DSCR Important?

A higher DSCR indicates a business has enough income to cover its debt, making it less risky for lenders. Banks usually look for a DSCR of at least 1.25 for stable investments like apartment buildings, meaning $1.25 in income for every $1 in debt. For businesses, which are riskier, a DSCR of 1.5 or higher is often preferred.

Applying DSCR in Business Purchases

When buying a business, ensuring a healthy DSCR is crucial. Here’s why:

Risk Management: A high DSCR means the business can comfortably cover its debt, reducing the risk of default.

Loan Approval: Lenders are more likely to approve loans for businesses with a high DSCR.

Financial Health: A good DSCR reflects strong financial health and sustainability of the business.

Common Issues with DSCR in Business Valuations.

Sometimes, sellers overvalue their businesses, leading to an unrealistic DSCR. A good business broker should stop this before even taking it to the market but let's be honest, most business brokers aren't good haha.

Here are some potential issues:

Inflated Cash Flows: Overestimating income or underestimating expenses can distort the DSCR. Don't be fooled into using Sellers Discretionary Earnings (SDE)to calculate your debt service ratio. Business brokers love to do this but banks won't fall for it. A savvy buyer and bank will need to factor in a "livable wage" for the buyer.

So Sellers Discretionary Earnings (SDE) - buyers livable wage = net operating income.

Let me break down a "bad business broker" example so you dont fall for their shenanigans:

Sellers Discretionary Earnings (SDE): $275,000

market multiple: 3.0

asking price: $825,000

Dont let them play games with you! Here is what it should be:

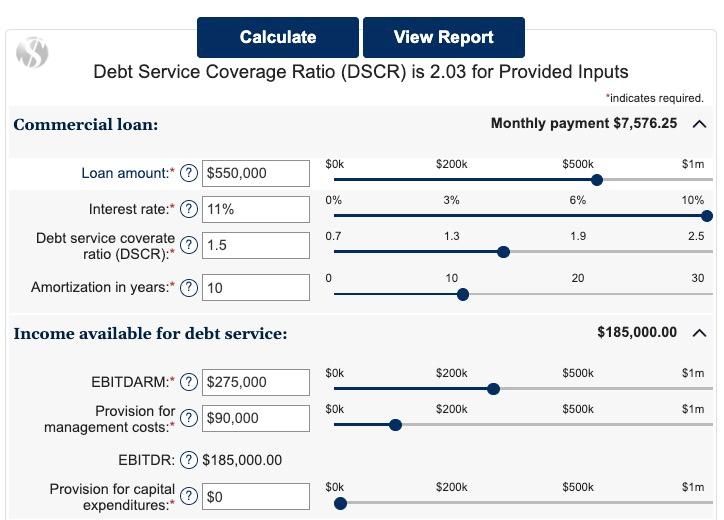

Sellers Discretionary Earnings (SDE): $275,000

Buyers livable wage: $90,000

market multiple: 3.0

asking price: $555,000 (275k-90k=185k*3.0)

Now this is a bankable deal you can get financing for all day long!

Improper Separation of Assets: Not correctly separating business operations from real estate can inflate perceived cash flow.

Ignoring Principal Payments: Principal payments are not expenses but can significantly impact cash flow, affecting DSCR.

Conclusion

Understanding and accurately calculating DSCR is essential when evaluating a business for purchase. It helps in making informed decisions and ensures that the business can meet its debt obligations comfortably.

p.s. I realize I am using the same multiple for SDE and EBITDA, that isnt the point of this post, its just to show the example of how to calculate DSCR and why its important to make sure a business is not over priced.

if we want to be accurate, we would apply an appropriate multiple for both SDE and EBITDA.